Passive Funds but Active Pricing: IS THAT FAIR??????

The whole rationale about passive funds is that you are not paying large fees to a fund manager in order to outperform the market. And, there has been considerable furore over “closet trackers” – managers charging large fees but basically selling tracker funds.

There are also passive funds which openly charge active fees, presumably preying on the lack of sophistication of its investors and charging excessive fees at the expense of their clients. The investors trust in the brand is being abused, is it not?

It was hoped that MIFID2 would change things – but some managers are continuing to charge these high, unjustifiable fees.

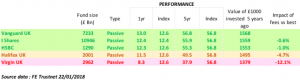

Lets look at a sample of 5 large UK FTSE Tracker funds – all with over £1bn Assets Under Management – See table below comparing performance over 5 years.

The best have low fees reflecting the passive investment and there is little to choose between the best funds.

Virgin’s UK tracker fund appears to massively underperform its peers – by more than 12% over the past 5 years – showing the effect of compounded high fees. If you consider it has £2.9 bn invested, the amounts taken in fees which could perhaps have been returned to investors are mind boggling.

Recent Comments